How to get QuickBooks Online for Cheap as a Non-Profit

I specialize in QuickBooks Online. It’s the only accounting solution I use with my clients. But if you’ve gone to browse pricing and plans for QuickBooks as the manager of a small non-profit, you might have some sticker shock. They do throw in a nice half-off discount for the first three months, but after that, even the most affordable, feature-poor QuickBooks Online Subscription is $35/month! (as of 2024). And it quickly grows from there if you need the additional features under the other plans.

QuickBooks Online plans are expensive! And that cost just keeps recurring.

Enter Techsoup

For 501(c)(3) non-profits and churches, I have amazing news. Techsoup is a non-profit tech marketplace where software giants including Intuit (publisher of QuickBooks Online), Microsoft, Adobe, Zoom, DocuSign and more donate keys and subscriptions for their software to be used free or deeply discounted by organizations like yours that are making a positive difference in the world.

In fact, many companies choose to exclusively offer their non-profit and charitable deals through Techsoup because Techsoup has an effective system for verifying the non-profit status of applicants.

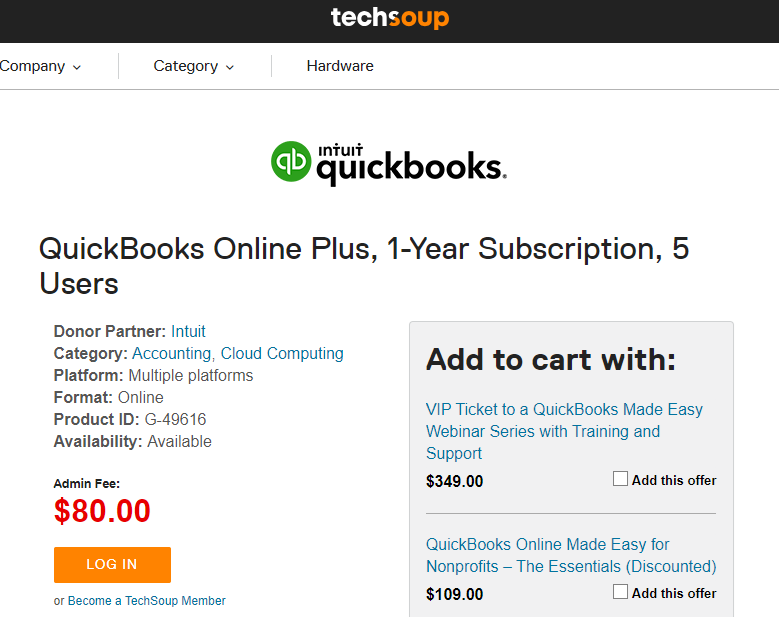

With Techsoup, you can get QuickBooks Online Plus for a year for $80, and Online Advanced for $170 (as of September 2024). Compare that to the sticker price - even including the three months at half off, you’d be paying $1,039.50 for your first year of Plus or $2,467.50 for your first year of Advanced. That makes for a crazy discount.

The best part is that these discounts make the software accessible for organizations that desperately need an accounting system, but could not realistically pay full price for it.

So what’s the catch? It’s legit - my own church uses Techsoup.

BUT you must demonstrate that your organization is a 501(c)(3) as determined by the IRS.

If you already know that your organization is a 501(c)(3) non-profit, and you have the documents to prove it, you’re home free. You will need to provide Techsoup with your EIN (employer identification number, issued by the IRS) and a copy of your determination letter if they request it. It may take a few days for them to verify your organization’s eligibility. Then you’ll be working with a shiny new subscription to QuickBooks Online!

Each year when it’s time to renew the subscription, be prepared to show evidence of your organization’s continued eligibility.

TIP: Write down the process when you go through it at the first renewal so you remember what steps to take next year.

The Awkward Spot for Churches - Don’t be Deterred!

If your organization is a church, you might not have a 501(c)(3) determination letter. The IRS considers churches to be 501(c)(3) eligible organizations by default, just by being a group of people formed to exercise their religion. Unlike other non-profits, they don’t have to file anything before they can accept donations that their donors can deduct on their taxes.

This is great (even essential) for small or new congregations, and effectively supports the free exercise of religion. But because donor software companies write off their contributions through Techsoup, they need evidence to demonstrate that their recipients are 501(c)(3) organizations. So you need the paper to get this benefit.

Before you get discouraged, there are a couple of things to check.

Has someone already applied for determination of 501(c)(3) status for your church, unbeknownst to you?

You can check the IRS’s Tax Exempt Organization Search tool and see if your church comes up. And if the determination letter was issued later than 2014, you will likely be able to find it here as well. If your church comes up but there is no document, you can request a copy of the determination letter from the IRS.

Is your church part of a larger denomination that may have a Group Decision on 501(c)(3) status that you fall under?

Many denominations including the United Methodist Church, the Global Methodist Church, the Episcopal Church, the Catholic Church (under the United States Conference of Catholic Bishops), the United Church of Christ, many Baptist state conventions, and the Evangelical Lutheran Church in America (among many others!) have applied for and received recognition of 501(c)(3) status for their entire denominational group. Many of these parent organizations have their own process that their member congregations can follow to obtain a letter of the group ruling and evidence of the congregation’s membership in the group, which can satisfy the requirement for Techsoup.

If all else fails, it’s absolutely doable.

If you’re absolutely sure that your church has not already received explicit acknowledgement from the IRS of its 501(c)(3) status, you can apply for it by following the IRS instructions for submitting form 1023 or 1023-EZ and paying a fee. I know this seems daunting, but you can do it without any specific tax or accounting experience. IRS forms and instructions are not as cryptic as their reputation suggests! If you need encouragement, just go back up and look at how deep those discounts are for QuickBooks Online for the first year alone. If you read through the instructions and still feel out of your depth, you could also consider whether it’s worth it to have a tax professional help you with this filing. This can save your organization thousands of dollars and get you the tool you need to see your money clearly.

QuickBooks is worth its sticker price - but you have better uses for those thousands, don’t you?